Lehman Bros., one of the largest investment banks in the USA, filed for bankruptcy protection a decade ago Saturday and triggered the worst financial crisis in modern American history. In the aftermath of the financial system’s collapse, as the excesses of Wall Street were revealed to the American public, people were shocked that banks had been allowed to make such reckless bets with their money. It seemed absurd that there were no rules in place to prevent these bankers from playing roulette with the U.S. economy on the line.

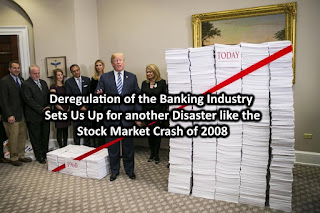

Ten years later, many of the rules and regulations put in place to prevent such a crisis from happening again are under attack. It would have been unthinkable as recently as a few years ago, but in the past year we’ve actually seen banking deregulation legislation pass Congress. In an effort to inflate profits for big banks, the Trump administration and Congress are setting us up for another crash.

https://en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%932008

Massive bail-outs of financial institutions were employed to prevent a possible collapse of the world financial system. In total, $623 billion in taxpayer money was dispersed via bailouts...

https://www.theguardian.com/commentisfree/2013/may/28/bank-bailout-cost-taxpayers

Last week, the Congressional Budget Office (CBO) released a report (pdf) with what seemed like good news: the bailout of 2008 – which fronted $700bn in taxpayer funds to prop up the financial institutions that brought the economy to the brink – ended up cheaper than expected. The price tag was revised down to $21bn from $24bn.

The picture was even rosier once you looked past how much it cost to bailout General Motors and insurance giant AIG. The cost of the bank bailout alone is, in fact, projected to be "almost nothing", as Politico's Morning Money blog put it. So insignificant was the harm done to taxpayers that Politico put "bailout" in quotation marks.

So, the hullabaloo was apparently for nothing. Far from being victims robbed of their tax dollars, the American public is essentially a winner in the bank rescue scheme – a shrewd investor who (involuntarily) played her cards right.

This is the line the banks and the US Treasury would like us to swallow. It is, of course, totally false. The bailout cost us plenty, and continues to do so. Sadly, it is the gift that keeps on giving to the very banks that drove our economy over a cliff – and took trillions in housing wealth, retirement funds and millions of jobs with it.

First of all, $21bn is no bargain. It's a hefty sum for a government we're constantly told is broke – and needs to cut everything from air traffic controllers to Medicare, and from meals for needy seniors to public defenders and housing aid. Broke – but somehow able to front $700bn for reckless, wildly mismanaged banks.

%20(1).jpg)

.jpg)

%20(1)%20(1).jpg)

.webp)

%20(1).jpg)

%20(1).jpg)

.jpg)